1. Who is obliged to pay PPK contributions from May 2021?

Employers who employ less than 20 employees are obliged to implement the PPK. This obligation also applies to foreign employers who employ workers in Poland, but do not have their seat in the territory of the Republic of Poland.

2. What are the deadlines for introducing PPK in the company?

As of January 1, 2021, the employers listed in point 1 has been automatically included in the government pension scheme. These employers are required to perform specific tasks:

- by April 23, 2021 at the latest, sign a PPK management contract with a financial institution

- by May 10, 2021 at the latest sign an agreement on running a PPK with a financial institution

The Lower Chamber od POlish Parliament (Sejm) has received a bill in which the Senate members had proposed to postpone the fourth stage of implementing the PPK (this applies to employers employing less than 20 people). They propose that these entities could conclude a contract for the management of the PPK by December 31, 2021. However, an agreement on running PPK – on January 10, 2022. The Act has not yet been adopted by the Sejm.

3. PPK for employees employed in foreign employing entities

In the case of an employing entity that has no seat in the territory of the Republic of Poland, in accordance with art. 5 of the PPK Act, it is possible to agree with the employee that his obligations under the PPK Act will be performed on his behalf by that person during the period of his employment in this employing entity. This arrangement is made by way of a written agreement between the employing entity and the employee, otherwise null and void.

This means that:

- a foreign employing entity that has a tax identification number (NIP) and is registered with the Social Insurance Institution as a payer of social security contributions – creates a PPK on general terms by concluding a PPK management contract and a contract for running a PPK on behalf of and for the benefit of persons employed on the dates indicated in point 2

- in a situation where an employee has taken over the duties of a foreign employer and has registered himself as a contribution payer with the Social Insurance Institution – the foreign employing entity agrees with him that his obligations under the PPK Act will be fulfilled on his behalf by that person employed during the period of her employment in this employing entity. In this case, the employed person will be obliged, under the terms of the contract concluded with the employing entity, also to conclude a PPK management contract, and then an agreement on running PPK with a financial institution.

If all employees submit to the employer a declaration of resignation from participation in the PPK, the employing entity is still obliged to sign a PPK management contract with the financial institution.

4. Can the employer be exempt from the obligation to implement PPK in the company?

The legislator introduced regulations which exempt some business entities from the obligation to introduce PPK in their organization under certain conditions.

The above option may be used by micro-entrepreneurs who meet the following conditions jointly in at least one of the last two financial years:

- the entrepreneur employs on average less than 10 employees per year

- the annual net turnover from the sale of goods and services of the enterprise does not exceed the PLN equivalent of EUR 2 million or the total assets of the balance sheet prepared at the end of one of these years do not exceed the PLN equivalent of EUR 2 million

An additional condition for exemption from introducing PPK in the company is the resignation from the program of all employees employed in a given organization.

5. How should the employer choose a company that will manage employee funds?

The choice of the financial institution should be agreed by the Employer with the trade union organization operating in the workplace or with the employee representation selected from among the employees. The employer may not select the institution managing the PPK funds unilaterally.

The list of institutions that have been entered in the PPK records and offer management of funds accumulated in the PPK, along with their offer, is available on the PPK Portal www.mojeppk.pl

The employer signs a PPK management contract with a selected financial institution, which should be concluded in electronic form, no later than 10 days before the deadline for concluding a PPK contract.

6. How to choose the employee representation that will take part in the implementation of PPK in the company? How many people should the representation count?

Employee representation should be selected in elections in which all employees of the enterprise will participate. To conduct the elections, it will be necessary to prepare the Regulations for the Election of Employee Representatives. Depending on the size of the enterprise, it is usually from 1 to 3 people. It is recommended that if possible there should be at least 2 employees.

7. Rules for participation in the PPK

The employer makes payments to the PPK only for employed persons, i.e. for employees and natural persons over 18 years of age, working under an agency contract or contract of mandate or other contract for the provision of services, e.g. management contracts and members of supervisory boards; if these persons are subject to compulsory retirement and disability pension insurance.

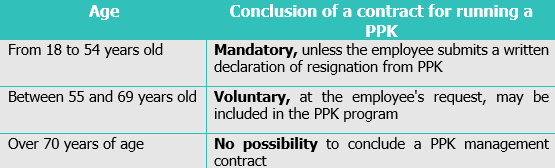

The possibility of concluding a PPK contract depends on the age of the employed person and is as follows:

If all employees submit to the employer a declaration of resignation from participation in the PPK, the employing entity is still obliged to sign a PPK management contract with the financial institution.

8. What is the amount of contributions to the PPK and when should they be transferred to the financial institution?

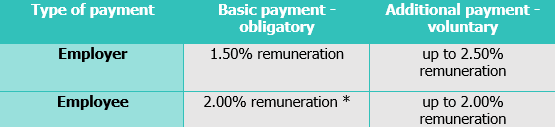

The employer and employee, as a participant in the Employee Capital Plans, finance the basic contributions from their own resources. In addition, both the Employee and the Employer may decide to make additional contributions.

9. Are contributions to the PPK a contributory and taxable income?

The amount of the contribution to the PPK financed by the Employer is not included in the basis for compulsory insurance contributions in ZUS. However, it is taxable income. Income will arise from both the basic and voluntary contributions financed by the employing entity.

10. Activities required to implement the PPK

More information on PPK can be obtained, among others, by watching the training in Polish or English:

PPK PL: https://www.youtube.com/watch?v=jjhzxE9fcRE

PPK ENG: https://youtu.be/I69At58HBJY