Transfer pricing documentation and policy

Members of entities trading with entities with which they have capital or personal links are required to document, under certain conditions, selected transactions in order to prove their marketability. Its diligent fulfilment is not facilitated by fluctuating and increasingly restrictive regulations, but at the same time the tax authorities are watching it ever more vigilantly. Furthermore, in order to carry out intra-group transactions properly, a well-constructed transfer pricing policy is of great importance. That is why at Nexia Advicero we offer complex services regarding the preparation of documentation and transfer pricing policy.

For Your transactions involving related entities we:

- review current TP practices;

- analyse transactions between related entities;

- carry out transfer pricing tax reviews;

- develop a transfer pricing policy and support its implementation;

- prepare local file documentation;

- complete and submit or send for submission the TPR-C form;

- settle the TP adjustments;

- provide support in the process of obtaining an Advance Pricing Agreement (APA)

- act on behalf of our Clients to initiate the Mutual Agreement Procedure (MAP).

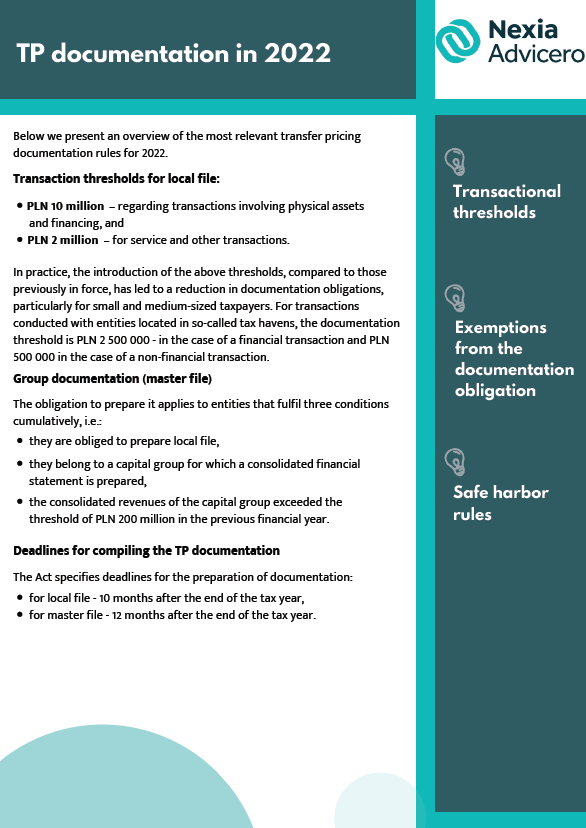

Transfer pricing services are provided by a team consisting of specialists with many years of experience in this field, who are constantly deepening their knowledge. They have also prepared an overview of the most relevant transfer pricing documentation rules for 2022, which we invite you to read.

28.12.2023

The most important issues in the area of transfer pricing in 2022

This post is also available in:

PL

PL