Technology and start-ups

Today, digital transformation in business is an increasingly used process to increase operational efficiency, improve a product or service offering or increase a company’s innovation. It is a strategy involving the use of new technologies such as data analytics, artificial intelligence, cloud computing or the implementation of blockchain technology. We support companies wishing to develop these processes internally or those just planning to introduce them into their structures.

We offer:

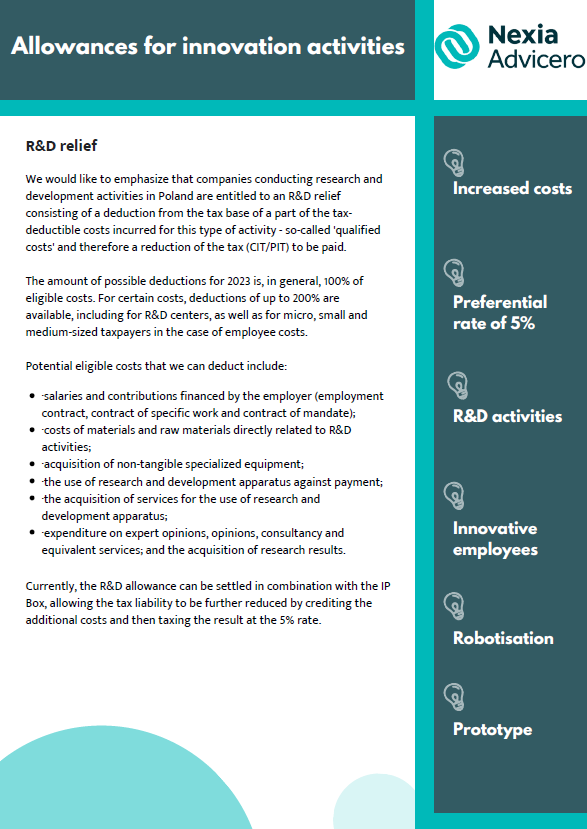

- Comprehensive support in the review of businesses, assessment of opportunities for innovative reliefs and assistance in their implementation (including R&D relief, IP BOX, for innovative employees, for robotization, 50% Deductible costs).

- Analysis of the tax structure of start-ups and technology companies in the development of an optimal tax structure with international advice.

- Analysis and advisory services related to licensing and copyright transfer agreements relating to intellectual property.

- Tax advisory services on the introduction of artificial intelligence, taking into account the correct legal policy.

- Support on tax issues related to blockchain technology, cryptocurrencies, NFT and the settlement of taxes thereon (including the receipt of remuneration in this form).

Our knowledge and experience allows us to understand new technologies in a practical way. We support both new investor businesses and start-ups comprehensively by focusing not only on the implementation of reliefs, but also on the overall alignment with tax policy for new technologies and innovative needs. Our support is directed both to individuals operating in IT/programming services and to Fintech companies, that focus on developing innovative solutions in their organization.

This post is also available in:

PL

PL