- The FIT/FIP system is not a subsidy, thus it cannot take advantage of CIT exemption

- URE President’s report – energy production from small installations in the year 2020

- Draft amendments to the Law on Renewable Energy Sources

- Energy Regulatory Office report for the year 2020

1. The FIT/FIP system is not a subsidy, thus it cannot take advantage of CIT exemption (ruling of WSA in Warsaw of 21 January 2021, ref. III SA/Wa 1150/20)

The dispute between tax authorities and the company concerned interpretation of regulations regarding the recognition of the feed-in-tariff (FIT) and feed-in-premium (FIP) systems as exempt from CIT.

The main activity of the company (the applicant) is generation of electricity, its transmission and distribution. The company planned to take advantage of new forms of support for generation of electricity from renewable energy sources – the feed-in tariff system and the feed-in-premium system. Moreover, the company could be qualified as a generator within the meaning of the RES Act of 20 February 2015. Therefore, the company presented the authority with a question: does the receipt of the above-mentioned forms of support constitute revenue within the meaning of the CIT Act?

The company took the view that in this case it could be said to be a subsidy and referred to the exemption under Article 17 Section 1 Point 47 of the CIT Act, applicable to subsidies received from the state budget or the budget of a local government unit. The company pointed out that there is no definition of the term “subsidy” and, in its opinion, referring to the applicable provisions, support under the FIT and FIP systems may be regarded as such. It referred to the jurisprudence of the CJEU concerning the recognition of state aid and the EU Commission Regulation declaring certain types of aid compatible with the internal market.

The director of the KIS did not agree with the applicant’s standpoint; he found that this form of aid is of an individualized nature, as evidenced by the fact that generators must meet a number of formal conditions set out in the RES Act. The authority agreed with the applicant that the systems referred to constitute subsidies for the implementation of public tasks, but in their essence they are completely separate sources of financing from subsidies. Moreover, the director of the KIS stressed that the basic difference between a subsidy and public aid is the discretionary nature of the subsidy. In conclusion, the authority found that receipt of one of the forms of support for electricity generation would constitute revenue.

The court agreed with the tax authority. In the court’s opinion, it is unjustified to assume by analogy that the FIT/FIP scheme should be subject to CIT exemption under the provisions on subsidies. Any reliefs and exemptions provided for in the Tax Act should be treated as exceptions to the general principle of universality of taxation, which means that they should always be treated strictly and not extensively.

2. URE President’s report – energy production from small installations in the year 2020

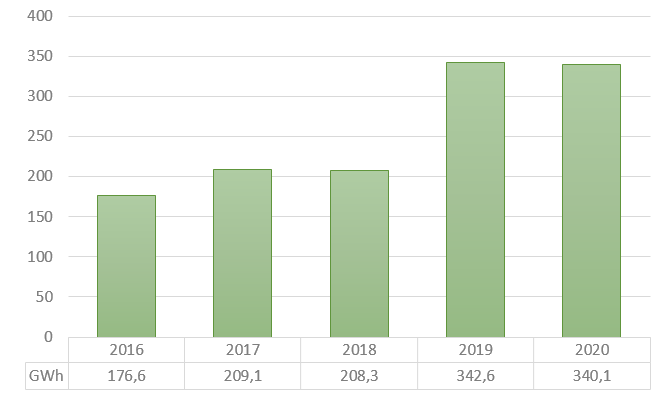

Energy production from small installations, according to a report by the Energy Regulatory Office, remained last year at a level similar to that of 2019. The structure of energy production itself in our country has changed slightly – this is the main conclusion coming from the latest report, published on 5 May 2021.

In Poland, the production of electricity from renewable energy sources amounts to almost 10 GW, of which in small RES installations it is over 183 MW (0.183 GW), while in micro installations it is over 3 GW. It is worth noting that at the end of 2016, the number of generators in small installations was 428, and after five years it was 765. According to the President of the Energy Regulatory Office, the energy transformation observed is mainly the development of renewable energy sources, largely those connected to distribution networks. Furthermore, it is pointed out that a balance between the benefits of “greening” the energy sector and the costs resulting from the cooperation of these sources with the energy system is crucial.

| Type of RES installation | Number of installations | Installed power [MW] |

| using hydropower (WO) | 343 | 51,96 |

| using solar energy (PV) | 328 | 66,86 |

| using biogas (BG) | 117 | 32,10 |

| using wind energy (WI) | 108 | 31,71 |

| using biomass (BM) | 2 | 0,47 |

| Total | 898 | 183,10 |

As can be seen from the table above, small-scale generators produced energy at a total of 898 sources (an increase of 81 installations compared to 2019 was recorded). The total capacity of installed installations was over 183 MW. Most were small sources using water energy (the number of installations was 343) with a capacity of 51.96 MW.

Generators in small RES installations last year produced 340 GWh of energy in 765 entities. Of this amount, 225 GWh (i.e. 66 per cent) was sold to an obligated seller, and 115 GWh (34 per cent) was consumed or resold to other sellers.

3. Draft amendments to the Law on Renewable Energy Sources

As announced by the Ministry of Development, Labour and Technology, on 26 April 2021 a draft amendment to the Act on Renewable Energy Sources was presented, which includes, among others, changes to the discount system and definitions of prosumers.

First of all, the ministerial draft is to end the operation of the system of discounts, however, it is worth noting that prosumers who launch an installation before the proposed changes enter into force will continue to benefit from them.

The system of discounts, in which prosumers for every 1 kWh of surplus energy not consumed and introduced to the grid receive a discount of 80 or 70 per cent, will be replaced by the possibility to sell unused surpluses at the price adopted in the act.

The possibility proposed by the Ministry to sell unused surpluses will be at the average wholesale market price of the previous quarter. However, the Ministry is open to a proposal to change the way the price is set.

The system is seen as less favourable than the current system of discounts.

A competitive project by a group of MPs led by Jadwiga Emilewicz has also appeared in the Sejm. The draft of the group of MPs proposes changes related to the billing rules for collective prosumers. The change is to involve adopting a rebate in the ratio of 1:1, but it is to cover only active energy, without distribution – which is to have a beneficial effect on distribution companies.

Moreover, it assumes, inter alia, that the definition of a classic, collective and virtual prosumer will be differentiated. A team from the Ministry of Labour and Technology is working on similar changes, but has so far failed to prepare final legislative proposals.

The amendments proposed by a group of MPs define a collective prosumer as “a final consumer who generates electricity exclusively from renewable energy sources for their own needs in a micro-installation or a small installation connected to the distribution network via an internal electrical installation of a multi-family building, provided that, in the case of a final consumer who is not a household consumer of electricity, such generation is not also part of their main business activity”.

A virtual prosumer, on the other hand, would be understood as “a final consumer who generates electricity exclusively from renewable energy sources for his own needs in a renewable energy source installation connected to the distribution network in a different place than the place of supply of electricity to this consumer, which at the same time is not connected to the distribution network via an internal electrical installation of a multi-family building, provided that in the case of a final consumer who is not a household consumer of electricity, this generation is not, moreover, the subject of the predominant economic activity”.

Moreover, the legislative proposal provides for the introduction, by way of an appropriate regulation, of more precise rules for phase-to-phase balancing, the lack of which in the Act causes numerous problems.

The amendment is planned to enter into force on 1 January 2022.

4. Energy Regulatory Office report for the year 2020

The Energy Regulatory Office’s 2020 report presenting data on the Polish energy market has been released.

The rules for shaping and calculating tariffs and settlements in electricity trading were changed by the entry into force of amendments to the Tariff Regulation in December 2020.

A new tool in tariff formation for infrastructure companies in the form of a regulatory account was introduced. In addition, for the first time the President of the Energy Regulatory Office introduced compensation for energy-intensive enterprises. As the President pointed out, the aim of the system is to reduce the risk of relocation of enterprises, which may consider moving their operations to another region due to indirect costs they are forced to bear in our country (the so-called carbon leakage phenomenon).

According to the publication of the Energy Regulatory Office, the total amount of support for 2019 (granted in 2020) was over PLN 340 million – 25 companies benefited from the scheme.

Another information is that in 2020 there were 8 auctions for the sale of electricity from renewable sources. This year, in the basket above 1 MW, photovoltaic installations competed with wind power farms. At the end of 2020, 185 entities held a licence to trade in gaseous fuels and 94 companies actively participated in natural gas trading. The share of PGNIG Group entities in gas sales to end-users was 85.63 per cent. This demonstrates the strong concentration on the retail gas market.

Information was also published on the number of disputes resolved. The President of the Energy Regulatory Office resolves disputable cases concerning refusal to conclude an agreement for connection to the network, e.g. in the case of unjustified interruption of gas or energy supply. The number of cases resolved by the Office was 312, most of which concerned gas (232), energy (69) and heat (11). The majority of the cases concerned refusals to connect to the gas grid and unjustified suspension of electricity supply.